Trump's New Tariff Threatens Nigeria's Fragile Economy

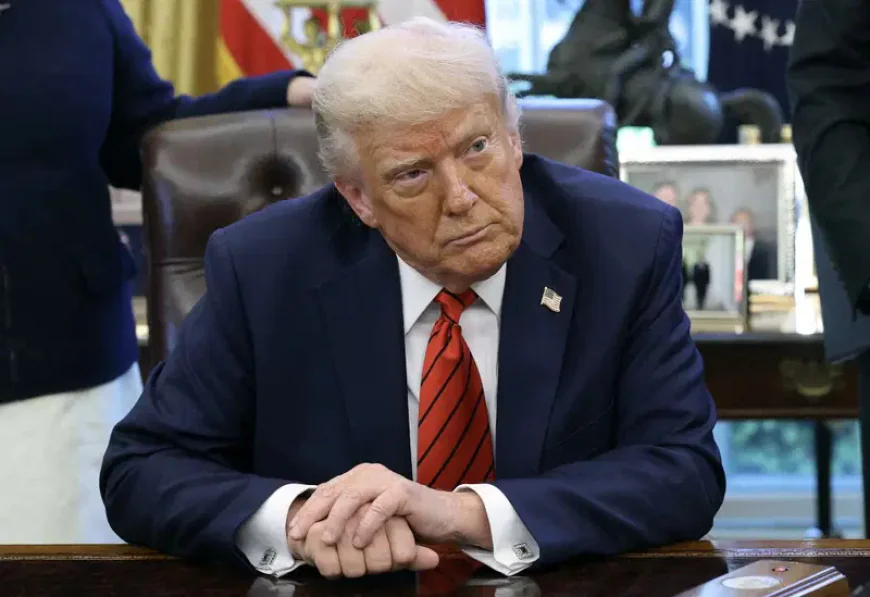

Nigeria’s economy, already facing hardship, risks another setback if the United States President, Donald Trump, follows through with his threat to add a new trade tariff on countries aligned with BRICS.

Countries in the BRICS group include Brazil, Russia, India, China, and South Africa. If the proposed tariff is enforced, Nigeria’s import duties to the US could rise to 24 percent, up from the 14 percent levy announced on April 2 during Trump’s “Liberation Day” speech.

Experts warn this increase could slow Nigeria’s efforts to diversify exports. The new threat comes amid criticism from BRICS leaders at a recent summit in Brazil, who called the import tariffs too broad and unfair. Remember, on April 2, Trump introduced a set of duties, setting a 10 percent baseline for 185 countries, including Nigeria. He also targeted countries he labeled as bad actors, sparking a trade war especially with China.

Trump suggested he could have set higher tariffs, but preferred to leave some room for negotiation. He gave three months for countries to reach deals, but only the UK and Vietnam recently did. The US and China agreed to temporarily lower tariffs on each other’s goods. Trump also warned he would impose tariffs unilaterally if countries didn’t make agreements by August 1.

BRICS members responded by condemning the tariffs, calling them illegal and harmful to global growth. Trump then threatened to add a 10 percent tariff on all BRICS countries that support anti-American policies. He made this announcement on his social media platform on Sunday.

BRICS now includes six coalition members, such as Egypt, Ethiopia, the UAE, Iran, Saudi Arabia, and Indonesia, which joined in 2024. Nigeria became the ninth BRICS partner in January 2025, joining Belarus, Bolivia, Cuba, Kazakhstan, Malaysia, Thailand, Uganda, and Uzbekistan. The 2024 summit in Kazan created the partner-country category, which Nigeria now holds.

President Bola Tinubu attended the summit at Brazil’s invitation, due to Nigeria’s ‘partner country’ status—short of full membership. Nigeria’s economy struggles despite being Africa’s largest.

Inflation remains high, and the country depends heavily on oil exports, which are volatile.

Inflation hit nearly 29 percent in December 2023 and climbed to 34.2 percent in June 2024 before falling back to around 27.5 percent recently. The Central Bank of Nigeria has kept rates steady after recent policy changes, including removing fuel subsidies and floating the naira’s exchange rate. Growth remains slow, averaging just 2.3 percent over the past decade.

Experts say an extra 10 percent tariff from the US could seriously hurt Nigeria’s exports. Oil exports make up most of Nigeria’s trade with the US, accounting for over 90 percent. Other exports like fertilizer and farm goods make up a smaller share.

Though Nigeria is a key US partner, it remains a tiny part of US trade. Higher tariffs could make it harder for Nigeria to expand other exports, and its reliance on oil makes it vulnerable to price swings.

At the summit, President Tinubu called for a rethink of global governance and financial systems. He pushed for a fairer system that benefits developing countries, especially in Africa. He highlighted that Africa contributed little to climate change but suffers the worst effects.

Tinubu emphasized that justice, equity, and accessible financing are needed for a new global order. He also said Nigeria supports BRICS’ goal of a more representative world. He urged cooperation on climate actions and health issues. Nigeria’s Vision 2050 aims for sustainability, focusing on youth, climate, and health. Tinubu stressed that Nigeria must not be a passive observer and called for Africa to have a real voice in global decisions.

Experts warn the new tariffs could hurt Nigeria’s ability to diversify exports. They say higher US tariffs might reduce foreign exchange earnings, putting pressure on Nigeria’s finances. The US trade office reported Nigeria’s exports to the US reached about five and a half billion dollars in 2024.

A tariff hike could make Nigerian goods less competitive, especially outside oil. This could slow efforts to find new markets. It risks strengthening Nigeria’s economic dependence on oil and exposing it to global price changes.

Analyst Clifford Egbomeade said this move deepens Nigeria’s economic problems. Most exports to the US are oil, which demand remains steady for. But Nigeria’s non-oil exports are already struggling to compete.

Higher tariffs threaten small industries and jobs.

They might also scare away foreign investors if relations sour. Nigeria must navigate its ties to BRICS carefully without risking retaliation or losing other trade partners. Diplomatic efforts should focus on trade talks and boosting intra-African trade. The answer lies in engaging with both the US and BRICS on Nigeria’s own terms.

Analyst David Adonri pointed out that the extra tariff would lower Nigeria’s export earnings and competitiveness. Nigeria must look for alternative markets and rely more on domestic production. He believes Nigeria’s economy would be better managed if policymakers had acted more wisely.