Germany Narrowly Avoids a Third Year of Recession

Germany’s growth hopes are stalled by slow action and tricky global trade.

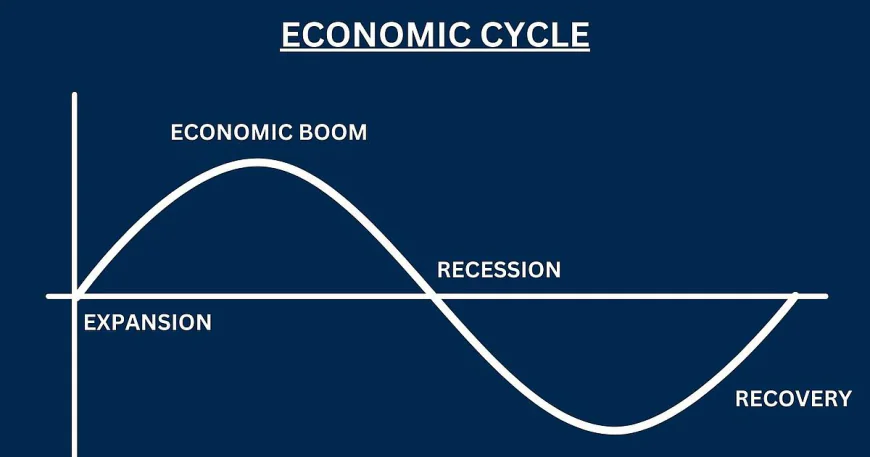

Germany’s economic recovery is proving more fragile than policymakers had hoped. After two consecutive years of contraction, Europe’s largest economy, “expanded by 0.2% in 2025, narrowly avoiding a third consecutive year of recession”.

Despite ambitious government investment plans and a modest domestic demand rebound, structural weaknesses, delayed fiscal implementation, and mounting global uncertainty continue to weigh heavily on economic momentum.

As Germany grapples with sluggish growth, volatile trade conditions and long-standing competitiveness challenges, the coming years will test whether policy reforms and investment strategies can deliver a sustainable turnaround — or whether the country risks becoming the laggard of advanced European economies.

The Impact of a Third Consecutive Year of Recession on Germany’s Economy

The possibility of a third consecutive year of recession or near-zero growth in Germany underscores a deep and sustained economic malaise for Europe’s largest economy. After two years of contraction, German GDP expanded by only about 0.2 per cent in 2025 — a very modest rebound that barely offsets the prior downturns.

Government forecasts now project just 1 per cent growth for 2026, down from earlier expectations of 1.3 per cent, and 1.3 per cent for 2027. If growth remains this weak, Germany would effectively spend three years in stagnation, even if not strictly technically in recession.

A long period of weak economic growth has real consequences for everyday life. When the economy stagnates, businesses are less likely to invest, fewer jobs are created, and unemployment can rise — especially in manufacturing and export industries, which are central to Germany’s economy.

Another year of stagnation would weigh heavily on public morale, potentially shape voter behaviour, and reduce Germany’s influence as a leading driver of European economic growth.

Analysts argue that without stronger structural reforms, Germany may underperform compared to its peers in both investment efficiency and exports. Years of near-stagnation risk permanently reducing the economy’s growth potential, rather than simply causing short-term weakness.

Why This Has Happened: Weaker-Than-Expected Recovery

Economy Minister Katherina Reiche attributed the downgrade directly to “the fact that the expected fiscal policy stimulus did not materialise quite as quickly, nor to the extent, as we had assumed.” While this still marks progress from contraction in 2024 and 2023, it falls short of earlier hopes for a robust rebound.

Both structural and short-term factors have contributed to the weaker recovery. Germany’s export-driven economy has been exposed to slowing global demand, rising protectionism and geopolitical uncertainty. After three consecutive years of export declines, growth is forecast at only 0.8 per cent in 2026.

Pressures such as potential U.S. tariffs and softer demand from China — two of Germany’s most important trading partners — have weighed heavily on manufacturing and business investment.

While domestic consumption has provided limited support, weak business investment and cautious corporate sentiment have restricted the recovery. The Ifo business climate index remained flat in early 2026, suggesting that companies are still reluctant to invest or hire despite fiscal stimulus. The German Economic Institute (IW) has also warned that slowing global trade and subdued export demand will continue to weigh on overall growth.

Reiche’s government has taken major steps to increase spending by loosening borrowing limits, allowing more money to be invested. However, these policies take time to show real results in the economy, such as higher employment and increased business activity.

In addition, structural issues such as high energy costs, demographic challenges, and bureaucratic inefficiencies have weighed on productivity and private investment. OECD analyses have stressed that these long-standing challenges have constrained Germany’s growth potential and muted the effects of fiscal stimulus.

Investment, Trade, and Outlook

Interview with Lars Klingbeil, Federal Minister of Finance

Interview with Lars Klingbeil, Federal Minister of Finance

Finance Minister Lars Klingbeil has been clear and consistent: the government’s investment push — while correct in direction — must be rolled out faster to have the intended economic impact.

“When it comes to implementation, we must further increase the pace,” he said, urging authorities to expedite the deployment of funds earmarked for infrastructure and other priority areas.

Klingbeil’s comments underline a central dilemma: Germany’s fiscal strategy is bold on paper, but the mechanics of allocating, approving and executing projects across federal and state levels have thus far introduced delays and inefficiencies.

According to official reporting, only a small portion of the €500 billion infrastructure fund had been disbursed by late 2025, underscoring the challenge of moving from commitment to construction.

At the same time, external conditions remain unfavourable. According to Reuters, the government’s annual economic report cautioned that “despite the largely robust development of global growth and trade, the global economic outlook remains difficult,” reflecting uncertainties in supply chains, geopolitical tensions and trade disruptions. Germany’s economy depends on exports, so instability in global trade creates serious obstacles.

The combination of slow government investment and unstable global trade makes policy less effective. Domestic stimulus—government efforts to boost spending and investment within Germany—is intended to counter weak international demand. But because these measures are being implemented slowly, businesses haven’t yet felt the full benefits, while global trade remains unpredictable.

Klingbeil’s call to speed up investment reflects two things: first, a practical recognition that slow administrative processes—known as bottlenecks, where paperwork, approvals, or logistics delay action—are holding things back; and second, a political need to show that Germany’s investment plans are not just ambitious on paper but actually work in practice.

How well domestic stimulus measures are implemented, alongside the challenges posed by unpredictable global trade, will be crucial in determining whether Germany’s modest growth becomes stable or remains fragile.

Strengthening Competitiveness: Productivity, Innovation, Skills and the Future

Looking ahead, policymakers are increasingly emphasising that investment alone is not enough — structural improvements are needed to enhance Germany’s long-term competitiveness.

Finance Minister Lars Klingbeil has stressed that the economy needs not only faster implementation of spending plans but also deeper reforms that improve productivity, encourage innovation, and develop a more adaptable workforce. These areas are seen as essential if Germany is to transform modest short-term growth into a durable recovery.

A key part of Klingbeil’s approach is to increase productivity across the economy. This means modernising how businesses operate, cutting red tape that slows down investments, and helping companies adopt new technologies faster. International organisations such as the OECD have repeatedly noted that Germany’s productivity growth has lagged that of other countries, partly due to strict regulations and slow, fragmented decision-making.

Klingbeil has also highlighted the importance of education and attracting skilled workers from abroad. Demographic trends — including an ageing population — have constrained labour market flexibility and contributed to skill shortages in sectors from construction to IT. Bringing in international talent and investing in education and training could help fill these gaps and elevate Germany’s human capital.

If carried out well, these reforms could help Germany grow faster and strengthen its place in the global economy. They would make the economy more resilient to shocks, like changes in global trade or new technologies, and less dependent on temporary government spending. Policymakers face the challenge of supporting the economy now while also making the long-term changes needed for lasting growth.