Inside the Saudi–China Economic Alliance

Saudi Arabia and China’s $107 billion economic alliance is shaking up global energy, trade, and the balance of Western power.

Saudi Arabia and China are deepening economic ties at a moment when global trade patterns and geopolitical alliances are in flux.

What began as an energy-driven relationship has evolved into a broad strategic partnership encompassing infrastructure, manufacturing, technology, and long-term investment.

With bilateral trade surpassing $107 billion and multi-billion-dollar projects tied to Saudi Vision 2030 and China’s Belt and Road Initiative, the relationship is reshaping economic influence across the Middle East and beyond.

As Riyadh diversifies away from oil dependence and Western markets, and Beijing secures energy supplies and global investment opportunities, the implications extend far beyond the two countries involved.

The growing Saudi–China economic partnership is altering energy dynamics, investment flows, and competitive pressures for Western economies — signalling a shift in the balance of global economic power toward Asia.

Depth of Saudi–China Economic Ties

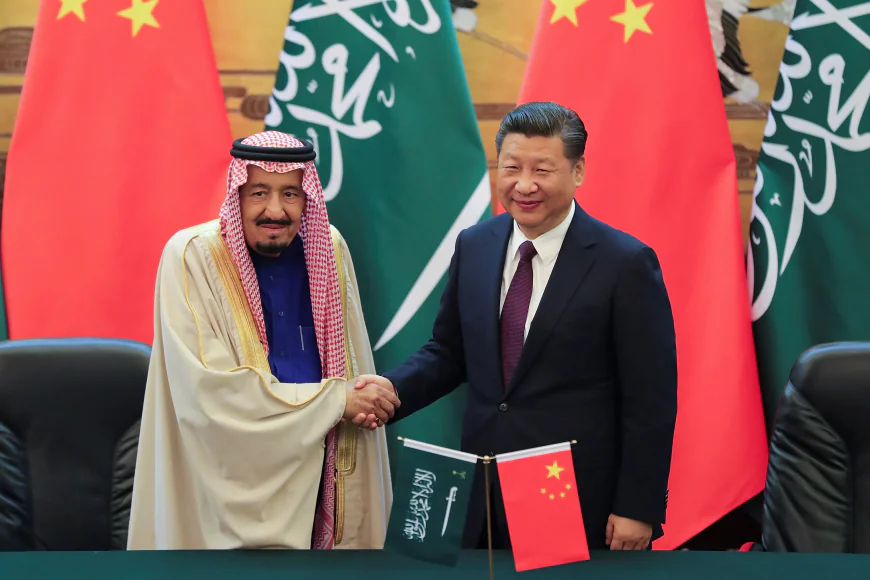

A high-level meeting between Saudi and Chinese leaders signals a partnership that extends far beyond diplomacy, touching the core of both nations’ long-term economic strategies.

China is Saudi Arabia’s largest trading partner, with bilateral trade exceeding $107 billion in 2023.

Bilateral trade refers to the total exchange of goods and services between two countries — encompassing both exports and imports. In this case, it includes Saudi exports of crude oil and petrochemicals to China, alongside Chinese exports of machinery, electronics, vehicles, construction materials, and manufactured goods to Saudi Arabia.

At the heart of this relationship is energy. Saudi Arabia supplies China with large volumes of crude oil and petrochemicals, helping to fuel China’s industrial expansion and strengthen its energy security. In return, Chinese exports support Saudi Arabia’s infrastructure development and industrial growth.

Beyond trade flows, the relationship has evolved into long-term cooperation through joint ventures, refinery investments, and industrial projects aligned with Saudi Vision 2030.

These include infrastructure and industrial economic zones designed to expand non-oil sectors. During previous summits, the two countries have signed investment agreements worth $25 billion or more, spanning energy, mining, technology, agriculture, logistics, finance, and infrastructure.

This growing interdependence provides China with a reliable energy partner while enabling Saudi Arabia to diversify away from Western markets and accelerate its transition toward a more industrialised and diversified economy.

Strategic Diversification and Saudi Economic Goals

Vision 2030 and Economic Transformation

Saudi Arabia remains heavily reliant on hydrocarbons, but Vision 2030 — championed by Crown Prince Mohammed bin Salman — aims to diversify revenue sources, expand industrial capacity, and generate employment.

Partnerships with Chinese firms directly support these goals. Agreements include factory development, construction materials manufacturing, logistics infrastructure, and large-scale housing projects — including plans to develop 20,000 housing units.

Chinese investment in real estate, logistics hubs, and infrastructure contributes to job creation, stimulates domestic demand, and strengthens Saudi Arabia’s regional export potential.

China’s Economic Incentives

For China, the partnership offers both energy security and diversification of global investment. As one of the world’s largest crude oil importers, China depends on stable fuel supplies to sustain industrial growth.

In 2023, China imported approximately 87.6 million tonnes of Saudi crude oil, accounting for 77 per cent of its total merchandise imports from Saudi Arabia.

Long-term access to Saudi energy helps protect China’s manufacturing base from supply disruptions and price volatility — a critical concern as it transitions toward cleaner energy while remaining reliant on fossil fuels.

Economic ties are increasingly reciprocal. Saudi Aramco is investing billions in integrated refining and petrochemical complexes in China, including a nearly $10 billion downstream facility, locking in long-term demand for Saudi crude while embedding Saudi capital in Chinese industrial growth.

At the same time, Saudi firms such as ACWA Power are pursuing large-scale investments in Chinese renewable energy and green hydrogen projects, with plans to invest up to $50 billion by 2030, highlighting shared long-term ambitions in energy transition and industrial cooperation.

Chinese companies have also secured major contracts for Saudi giga-projects — including projects worth more than $1 billion in sectors such as cultural infrastructure and university construction — strengthening China’s global business footprint and overseas revenue streams.

Ripple Effects on the Global and Regional Economy

Implications for the United States and Western Economies

Deepening Saudi–China economic ties carry significant implications for the United States and other Western economies. As Riyadh strengthens its partnership with Beijing, Western firms face increasing competition for access to Saudi markets, infrastructure contracts, and long-term investment opportunities tied to Vision 2030.

For decades, Saudi Arabia has played a central role in global energy markets while maintaining close economic coordination with the U.S. A stronger alignment with China — now the world’s largest energy consumer — could gradually shift economic influence toward Asia, affecting global oil pricing dynamics, supply routes, and the balance of leverage in energy markets.

Beyond energy, Saudi Arabia’s diversification toward China reduces reliance on Western exports, technology, and capital. This trend may prompt the U.S. and European economies to reassess trade strategies, foreign direct investment priorities, and their broader economic engagement with the Middle East.

Shifts in Global Investment and Trade Patterns

Chinese involvement in Saudi Arabia contributes to new centres of economic gravity. Capital, expertise, and infrastructure investment support sectors that can later connect into Asian and African markets — particularly through China’s Belt and Road Initiative (BRI).

Launched in 2013, the BRI aims to connect countries through trade, infrastructure, and investment. The “Belt” refers to overland routes such as railways, roads, and pipelines linking China with Asia, the Middle East, Europe, and Africa, while the “Road” refers to maritime trade routes connecting ports and shipping lanes across Asia, Africa, and Europe.

Through the BRI, China invests in transport infrastructure, energy projects, industrial zones, and digital networks to reduce trade costs, secure access to key markets and resources, and expand its economic influence.

Saudi Arabia plays a pivotal role in this framework. Positioned at the crossroads of Asia, Europe, and Africa and as a major energy supplier, the kingdom aligns naturally with BRI ambitions. At the same time, BRI-linked investment supports Saudi Vision 2030 objectives by accelerating diversification, infrastructure development, and global trade integration.