MiniPay by Celo: A Digital Wallet Reshaping Financial Access in Africa

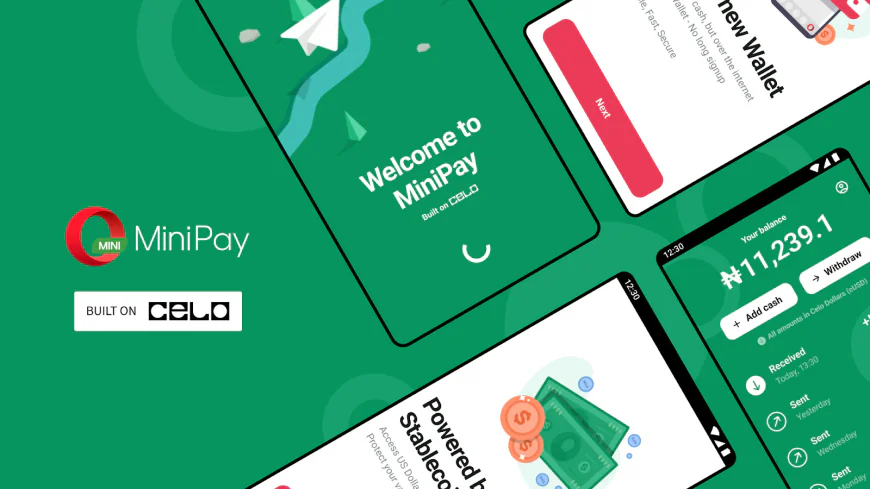

A new mobile wallet called MiniPay has launched in Africa's growing digital economy. MiniPay helps users who often cannot access traditional banking services. It was created by Celo, Mento Labs, and Opera. MiniPay is designed to be lightweight and user-friendly. It focuses on affordability, speed, and reliability, making it an ideal choice for areas where these factors are particularly important.

What is MiniPay and Why Was It Built?

MiniPay is a mobile-first, non-custodial wallet designed to make digital money easy and affordable for anyone with a smartphone. At just around 2MB in size, it fits easily on low-storage phones, even those with slower internet connections. Unlike traditional wallets that require long sign-up processes and complicated security steps, MiniPay simplifies onboarding through phone numbers and Google logins. It even backs up private keys to Google Drive, ensuring that users can recover access without technical knowledge.

The app was designed with African users in mind, where economic instability and high mobile money fees often limit financial access. MiniPay removes these barriers by enabling lightning-fast transactions that cost less than a cent, powered by stablecoins pegged to the US dollar. This means users can store and transfer money without worrying about local currency depreciation.

Solving Real Problems with Simple Tools

For millions of users in countries like Ghana, Nigeria, Kenya, and South Africa, sending and receiving money can be slow and expensive. Mobile money systems are often plagued by hidden fees, network delays, or outages. MiniPay steps in as a seamless alternative. Transactions typically complete in under five seconds, and the costs are nearly invisible.

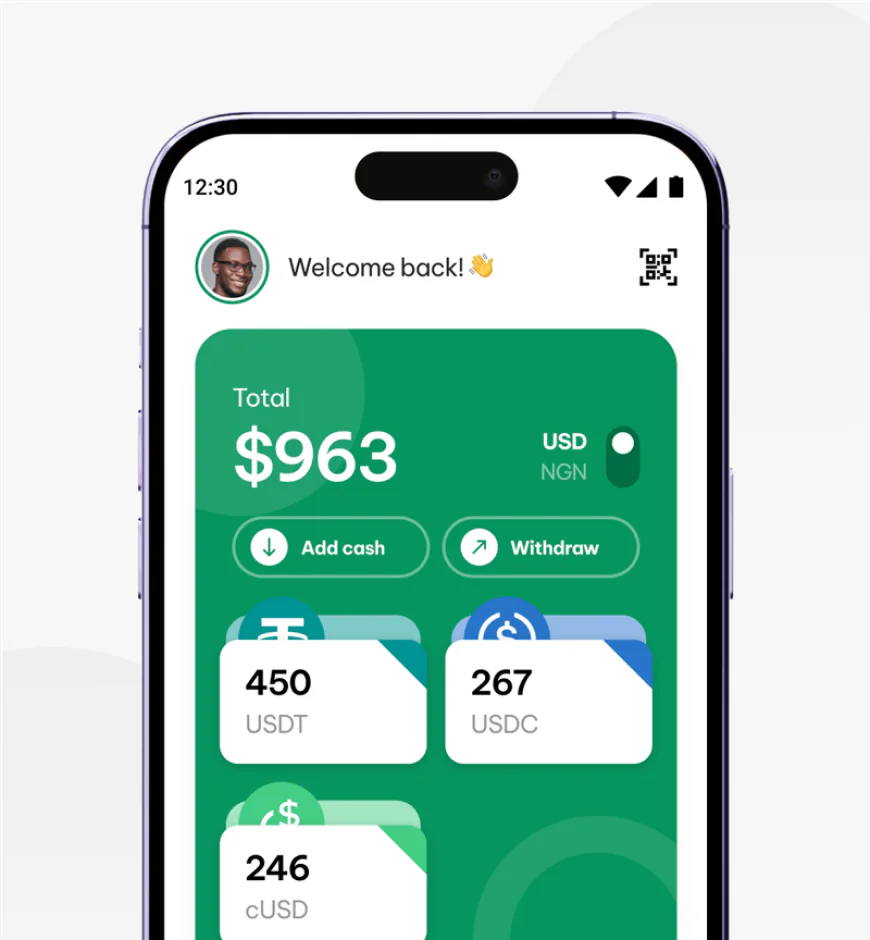

One standout feature is "Pockets," a tool that allows users to organize and convert between different stablecoins such as cUSD, USDC, and USDT. Whether someone is saving in dollars, receiving payments for remote work, or paying bills, Pockets offers flexibility without the complexity of traditional exchanges.

Beyond transfers, MiniPay connects users to a range of services through its built-in marketplace. Users can pay utility bills, top up mobile data, buy gift cards, or access apps for learning, gaming, and freelance gigs. For freelancers, especially, the ability to receive micro-payments in stablecoins through integrated platforms like Mural has proven to be a game-changer.

Widespread Adoption Across Africa

MiniPay has not only gained attention, but it has also gained millions of users. Within a few months of its launch, it was already active in countries like Ghana and Nigeria, and the numbers continue to grow rapidly. As of mid-2024, the app has crossed several million activations, with transaction volumes soaring into the tens of millions of dollars.

Much of this growth can be attributed to MiniPay's accessibility. Users don’t need a bank account or a high-end smartphone. With just a phone number and the Opera Mini browser or standalone MiniPay app, they are connected to a full digital wallet.

Empowering Communities Through Innovation

MiniPay is more than a financial tool. It is part of a larger vision to bridge the digital divide. Its developers have introduced features that support gig workers, small businesses, and even students. Partnerships with companies like BitGifty allow users to access local services using digital money, while new integrations are constantly being added to serve more use cases.

By anchoring itself to Celo’s blockchain and phone number-based identity system, MiniPay provides security and transparency without creating friction. The wallet’s infrastructure also ensures that user funds are safe, easy to access, and protected from inflation through the use of stablecoins.

In a region where every cedi, naira, or shilling counts, MiniPay is proving that technology can be both powerful and practical. It is not just another digital wallet. It is a lifeline for millions seeking better control over their money, better access to services, and a real shot at financial freedom.

For those exploring options beyond traditional mobile money, MiniPay is worth a closer look. It combines the reliability of blockchain with the simplicity of everyday tools, putting financial empowerment directly into the hands of those who need it most.