German Exports to U.S. & China Fall Sharply

Germany’s exports stall as U.S. and Chinese demand drops, highlighting vulnerabilities in a shifting global trade landscape and the urgent need for diversification.

Germany’s export engine — long the backbone of Europe’s largest economy — is sputtering. Once a global leader in automotive, machinery, chemicals, and high-tech manufacturing, the country now faces declining demand from key markets, rising competition, and supply-chain disruptions.

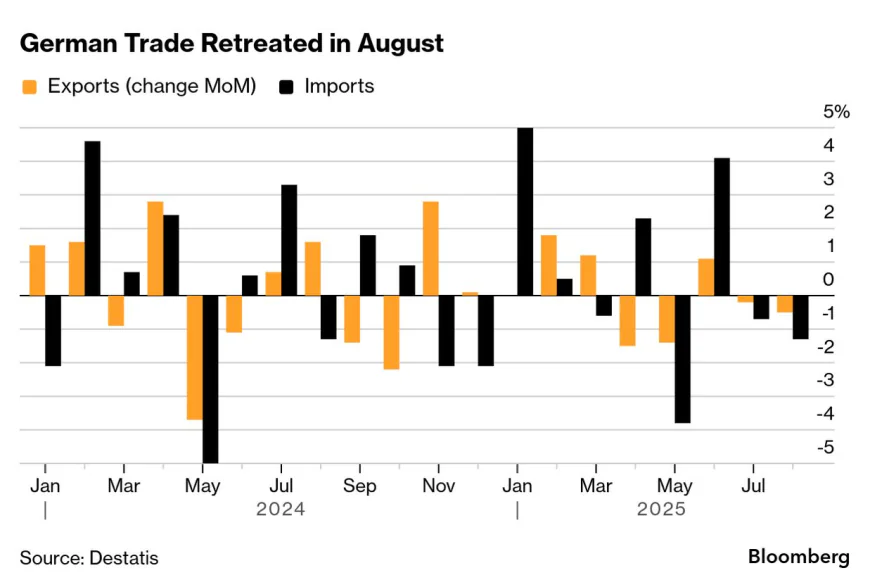

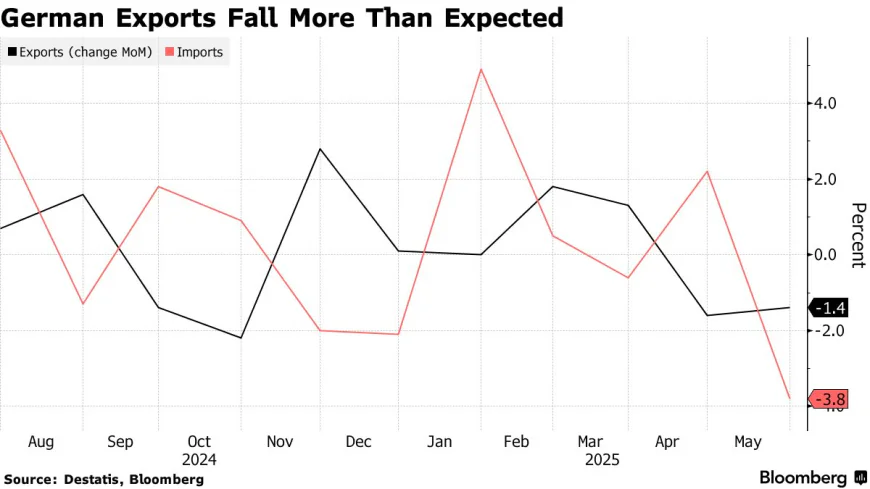

Recent data show exports to the United States and China — two of Germany’s most important non-EU partners — dropping sharply, even as intra-EU trade provides only a partial buffer.

This mounting volatility underscores a broader reality: Germany’s economic resilience is increasingly dependent on diversification, both in its markets and supply chains, as global trade undergoes profound shifts in both its geopolitical and structural aspects.

Recent sharp falls in exports to the US and China illustrate volatility

In October 2025, exports from Germany — Europe’s largest economy — barely budged, rising a marginal 0.1% month-on-month to roughly €131.3 billion, according to federal trade data.

On the surface, the increase seems modest, but it reflects deeper troubles: while trade within the European Union rose, shipments to two of Germany’s historically crucial markets — the United States and China — slumped sharply.

Specifically, according to Trading Economics, exports to the U.S. fell by 7.8% month-on-month, while Chinese demand dropped by 5.8%. This shift highlights a broader reallocation of Germany’s trade flows: intra-EU trade has helped prop up export numbers, but global demand remains weak overall.

As one analysis put it, "The volatility from US frontloading appears to have passed, and German exports are back to their new normality: sluggish growth".

Due to these declines, Germany’s overall export growth has become fragile: while intra-EU trade rose 2.7%, it was insufficient to fully offset the losses outside the EU.

Underlying causes include rising protectionism — such as U.S. tariffs on certain EU goods — weaker demand abroad, increased global competition (especially from efficient Chinese manufacturers), and lingering supply-chain upheaval.

Broader signal: Global trade is shifting, and diversification is increasingly strategic

According to a 2025 global-trade analysis, macro-economic shifts and “geopolitics” are reshaping global trade flows; economies must adapt by diversifying supply chains and trade partners to remain resilient.

McKinsey & Company notes in its 2025 update that global trade patterns are reconfiguring “along geopolitical lines,” with trade corridors shifting as countries reassess their sourcing and market strategies.

In that context, McKinsey warns that “over 30 per cent of global trade in 2035 could swing from one trade corridor to another” — underlining how volatile and uncertain trade flows may become if companies and economies don’t adapt.

Some European companies are already accelerating supply-chain diversification away from China in response to trade uncertainty and changing global demand — a trend Germany could leverage.

According to a 2025 report by the European Union Chamber of Commerce in China, more than 70 % of European firms currently operating in China “have reviewed their supply-chain strategies” in the past two years.

The Chamber’s president, Jens Eskelund, said bluntly:

“China’s export controls have increased the uncertainty felt by European businesses operating in the country, with companies facing the risks of production slowdowns or even stoppages.”

Moreover, the shift is already visible in concrete numbers: the report found that in the pharmaceutical sector, 80 % of firms are increasing “localisation,” while 33% of IT and telecom firms and 25% of retailers are diversifying away from China.

These developments illustrate that trade uncertainty and geopolitical pressures are already leading firms to reduce reliance on Chinese-centred supply chains — a trend that could benefit economies like Germany’s if they actively support diversification and alternative trade links.

Impacts on Germany and the Global Economy

Economic wobble at home

Germany’s export weakness comes at a fragile moment: after two consecutive years of contraction, the German economy remains on shaky ground.

Export-driven sectors — manufacturing, automotive, machinery, chemicals — have traditionally been core to national growth and employment. With exports stagnating, many firms are struggling to remain competitive, and investor confidence has suffered a setback.

Data from think.ing shows that in October, imports into Germany fell by 1.2%, even as exports barely grew, widening the trade surplus to €16.9 billion. But a surplus is little comfort when the engine of growth is sputtering: domestic demand remains weak, corporate investment is cautious, and unemployment risks are rising — especially in export-dependent industries.

Moreover, the weakening export sector is increasingly weighing on the business landscape, as firms struggle to stay competitive, and many are scaling back, with a surge in insolvencies expected.

According to a 2025 report by Creditreform, around 23,900 companies are projected to file for bankruptcy this year — the highest number in over a decade — a sharp rise tied to the prolonged downturn.

The head of Creditreform’s economic research warned that “this puts small and medium-sized businesses, in particular, under immense pressure,” underlining the risks to employment, supplier networks, and regional economies.

Global ripple effects

Germany’s trade slowdown reverberates beyond its borders. As global demand softens and tariff regimes proliferate, countries reliant on German machinery, industrial goods, or high-end manufacturing feel the ripple effects. Experts warn that renewed trade tensions — particularly between the U.S., EU, and China — could deepen a global trade slowdown already underway.

Moreover, Germany’s reorientation toward EU markets rather than the U.S. or China may shift supply-chain patterns, putting pressure on non-EU suppliers and reshaping trade relationships. Analysts caution this could accelerate structural shifts in global trade networks.